Three quick takes #1

Good morning fam. It’s janusz and I’m back from vacation. Hitting you with some takes that are top of mind for me.

First, an insight

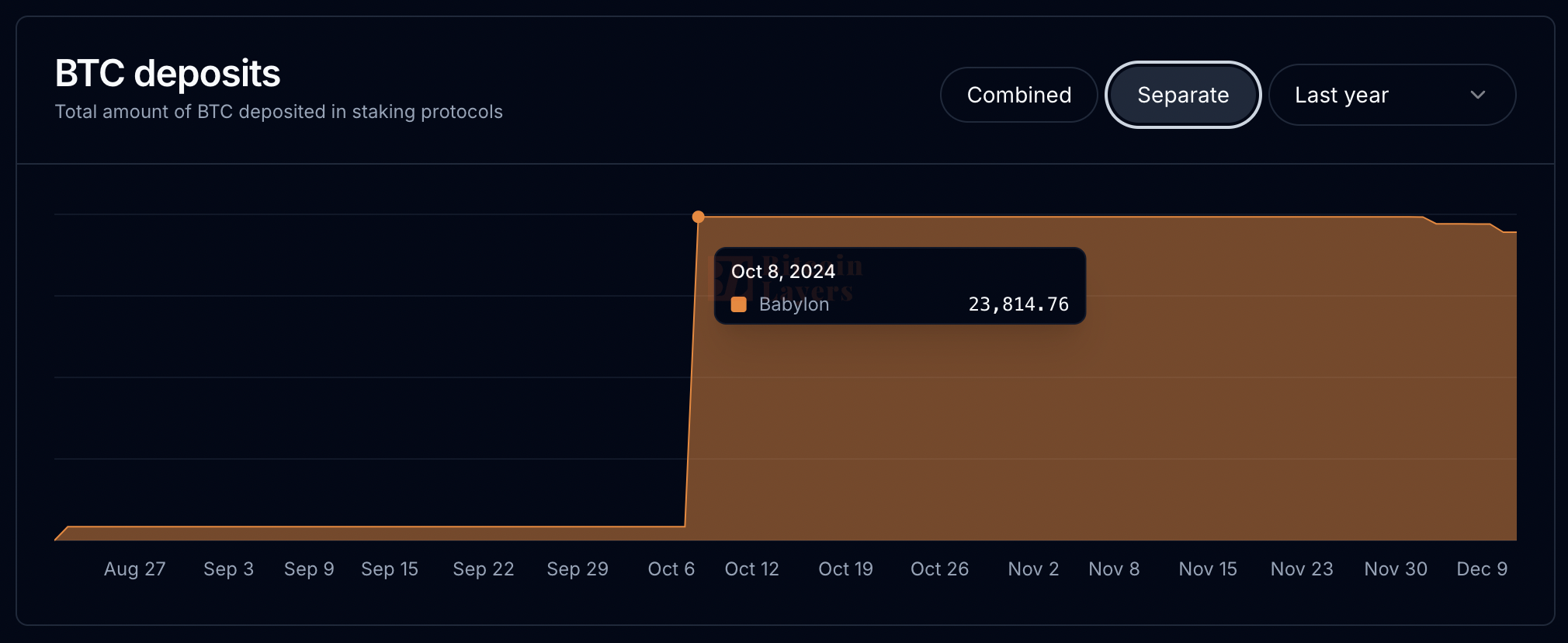

Main insight is that Babylon's second cap of deposits saw 22,500~ BTC deposited over 10 blocks.

Tomorrow, the third cap opens up and will run over 1,000 blocks. We hitting 100k deposits during Cap-3?

Janusz’s takes

It’s just chains and bridges

Teams are posting their latest developments to improve their “L2” and it typically has to do with the bridge.

Most things, at least on my radar, are typically blockchains that offer some (more) expressive execution environment that lets people lock some bitcoin into a bridge, on bitcoin, that gives them some tokenized version of it on the sidesystem in return.

So when people think of an “L2” they think of these things combined into one 👆 But, as I’ve been saying recently, there can be more than one bridge. These bridges can be of any design. They can vary in trust assumptions.

If a rollup team builds a corresponding BitVM-inspired bridge to accompany its rollup blockchain, that doesn’t mean it will be the only bridge connected to said blockchain. It can even have another BitVM-inspired bridge 🤯

The idea of “many bridges” connecting to chains is already happening. This is evident on a number of “bitcoin layers” and will only continue to progress.

Being an L2 is meaningless

Back in May, I gave a talk at Pizza Day Prague covering why defining the term L2 is pointless, and that marketing plans will always overshadow how designs actually work.

Plus, we’ll never agree on the term. It’s a dead end. It’s not even worth trying at this point.

What we should analyze is if a specific protocol sees users retain custody of their funds locked on the L1. If users don’t have custody, we should review the mechanism custodying the funds backing BTC tokens on the layer.

That’s why we have the “BTC Custody” category at the top of our protocol reviews 😇 A user either has custody of their funds or they don’t.

Derivatives backing derivatives

Red is currently in the weeds looking how various BTC-backed tokens are being leveraged across this “bitcoin DeFi” ecosystem. And it’s kinda wild.

Newer BTC-backed tokens are being backed by other… BTC-backed tokens. These tokens are being exchanged for other BTC-backed tokens and custodians are taking the BTC-backed tokens (backed by BTC-backed tokens) and depositing them into staking contracts, using them in trading strategies, and more.

Redemptions for these BTC-backed tokens can take quite a while… because the custodian needs to sell their BTC, or other BTC-backed token, to get the version users originally gave the custodian…

This is about the point where he lost me 😅

PS. We’ve got something coming soon on analyzing these tokens.